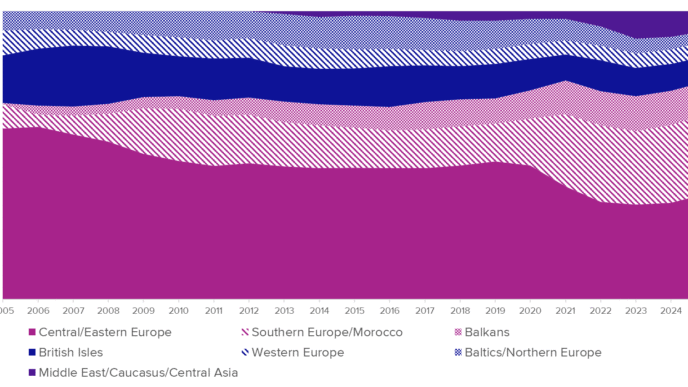

I know we’re deep into Q2 earnings season, but let’s take a quick detour back to Q1. I admit, I was a bit slow on the uptake. After the Department of Transportation (DOT) released the Q1 2025 figures, I initially focused on the changes in unit revenue and capacity for airlines, missing out on ancillary revenues. Thanks to your feedback, I went back to crunch the numbers myself to calculate the total unit revenue (TRASM). You might find the results surprising.

Previously, the chart based on stage length-adjusted unit revenue (SLA PRASM) showed Avelo as the clear underperformer, with few airlines standing out as winners. But when you factor in total operating revenue divided by available seat miles, which includes all ancillary revenues, the picture changes. The new TRASM chart reveals that Avelo still lags behind, but Alaska Airlines emerges as the new leader, showing significant growth in both TRASM and capacity. I also included Hawaiian Airlines this time, which made notable gains in its network. Southwest still had a strong quarter, but Alaska’s performance is hard to ignore.

JetBlue and Breeze also see a turnaround in their fortunes. Despite a drop in PRASM, their TRASM figures show improvement, especially for Breeze, thanks to increased ancillary revenues. Among the big three, American Airlines improved slightly, likely due to a low comparison base from 2024. United Airlines surged ahead with non-fare revenue increases, while Delta slipped back, though starting from a high point. The ultra-low-cost carriers (ULCCs) like Sun Country, Frontier, and Spirit didn’t fare well in this comparison, showing declines.

#AirlineIndustry #TRASM #AviationInsights #Q12025 #AviationEconomics

Originally reported by Cranky Flier Read More