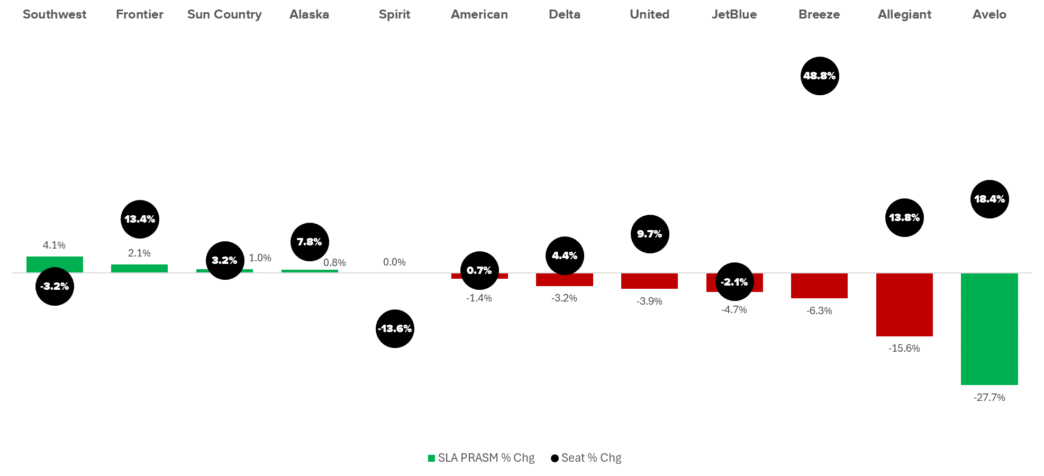

While I was away on vacation, the first quarter DB1B data was released by the government, giving us a detailed view of the airline industry’s revenue at the start of the year. Unfortunately, the overall picture wasn’t great, but there were some bright spots, notably Southwest and even Frontier. On the downside, Avelo had the poorest performance by a significant margin.

It’s important to note that this data is strictly domestic. If we were discussing international flights, the scenario would be different, as demand for premium cabins on long-haul routes has remained strong. The domestic market, particularly in economy class, has been the real challenge this year. With that context, let’s dive into the numbers.

According to Cirium data, adjusted for unit revenue per 1,000 miles, Southwest stood out with an impressive performance. Although its capacity was reduced, which naturally boosts unit revenue, the airline’s yield increased by over 10 percent. Despite filling fewer seats at these higher fares, Southwest still came out ahead. It’s worth mentioning that Southwest hasn’t yet implemented new revenue strategies like extra legroom or assigned seating, nor does it charge baggage fees. This success is purely due to effective fare and availability management. It seems Southwest had lost focus for a while, but it’s now making a swift recovery, which is a strong result for the airline.

Digging deeper, there were some unexpected findings. Among top markets, Denver led with nearly a 6 percent increase, while BWI was the only one to see a decline in the top tier. The standout performers included Nashville, which saw a remarkable 10.7 percent increase despite a 7 percent rise in capacity. This highlights why Southwest chose Nashville over Atlanta. Orlando’s unit revenue surged by 13.4 percent as ultra-low-cost carriers (ULCCs) scaled back, and Austin was up 11.5 percent, largely due to American Airlines pulling back from its focus city there.

Frontier also had a good quarter, with unit revenue growing by just over 2 percent, despite a 13 percent increase in seats. That’s a significant capacity increase for unit revenue to still rise. Frontier’s previous struggles made for an easier year-over-year comparison than for non-ULCCs.

Alaska Airlines also performed well, with a slight increase in unit revenue despite a substantial capacity boost. Note that this data excludes Hawaiian Airlines to avoid excessive noise.

Spirit Airlines might seem surprisingly mid-pack, but given its significant reduction in seats, seeing flat unit revenue is actually concerning. After Spirit, we enter negative territory, but the big three airlines are still in relatively good shape.

#AirlineIndustry #AviationNews #SouthwestSuccess

Originally reported by Cranky Flier Read More